No, this is not a post about the current state of our country, politics, or the stock market. We all get more than enough of that on the nightly news, and frankly, I'm burnt out on that. It's time to get back to my real love, writing about the restaurant biz.

I posted many months ago about my former employer, Brinker International, and their troubles trying to unload Macaroni Grill. When I worked there as an Assistant Manager, we were given stock options at a pre-determined price. If I recall correctly, my first options were in the $24/share range, and at the time they were selling for around $26. But, I never bought any. The next year, there were some I.R.S. changes in the works, so we were offered options at around $32/share on a smaller amount of shares. At that time, shares were selling for around $30/share, but there were rumors of an impending stock split. Again, I didn't bite. The next year, Brinker changed their whole bonus/perk policy and only offered stock options to those who were General Managers and above. Boy, was I pissed, even though I had never taken advantage of the previous offers. Many did, though, and many are now hurting financially.

Alas, it was the beginning of the end for me anyway, for they restructured the whole bonus policy and other things, too. I was on the way out the door, but I was still kicking myself for not buying stock when the getting was good. Some other managers had bought their maximum amount and were sitting on many thousands of dollars of potential profit. I used to look in the stock section of the Business pages of the newspaper religiously, if only for the purpose of berating myself for not taking advantage of the stock options. But that was years ago, and I had lost all curiosity about what was happening with Brinker stock when I left the company.

Last week, while going through the paper during lunch, I had the crazy idea of looking up how the stock was doing now. Now, I knew things had changed quite a bit in the last few years, but I was shocked when I got to the list. Brinker stock is now selling for just over $8/share. OMG! I can't imagine how outraged I would be if I had bought my maximum amount years ago. I called up all my old management friends and asked them if they had any stock options they had acted on. Out of six that I called, only two had bought the options. One had bought the options but sold them a few years back at a tidy profit to buy a house. The other is still holding onto them, hoping a sell of MacGrill will drive up the price.

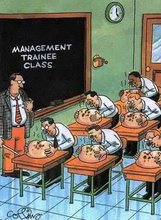

Back when I was a manager, I used to speak 'not so nice' about the shareholders. "The shareholders" was always the excuse our District Managers used to use when another round of penny-pinching was implemented. When I started, if you broke the 20% labor cost threshold, you were doing well indeed. Then 19%, then 18%, all the way down to 16% when I left. Managers were required to cut staff to skeletal levels and to step in and do the work instead. Between bussing tables, hosting, food running, prep work, and many other tasks, managers had no time to manage anymore.

It was a downward spiral that has put a lot of chain restaurants in a precarious position. Not only did labor costs have to go down, so did food cost, maintenance cost, smallwares cost, etc. Suddenly, offering quasi-first-class experiences while dining out became second consideration. House-made became frozen-in-a-plasic-bag-inside-a-cardboard-box. Three table sections became "How many tables can you take?". Hostesses became an option. Bussing was added to the servers list of things to do. Along with expediting and food running.

Until shareholders of restaurant stock realize that this business is for the long term and not for big dividends every quarter, publicly owned restaurants will always suffer. Overworked managers, servers, and cooks will not increase the value of your stock. It will only get you a lower class of employee who will put up with the bull-shit. And you know where that leads...stock at a 20 year low.

Saturday, November 15, 2008

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment